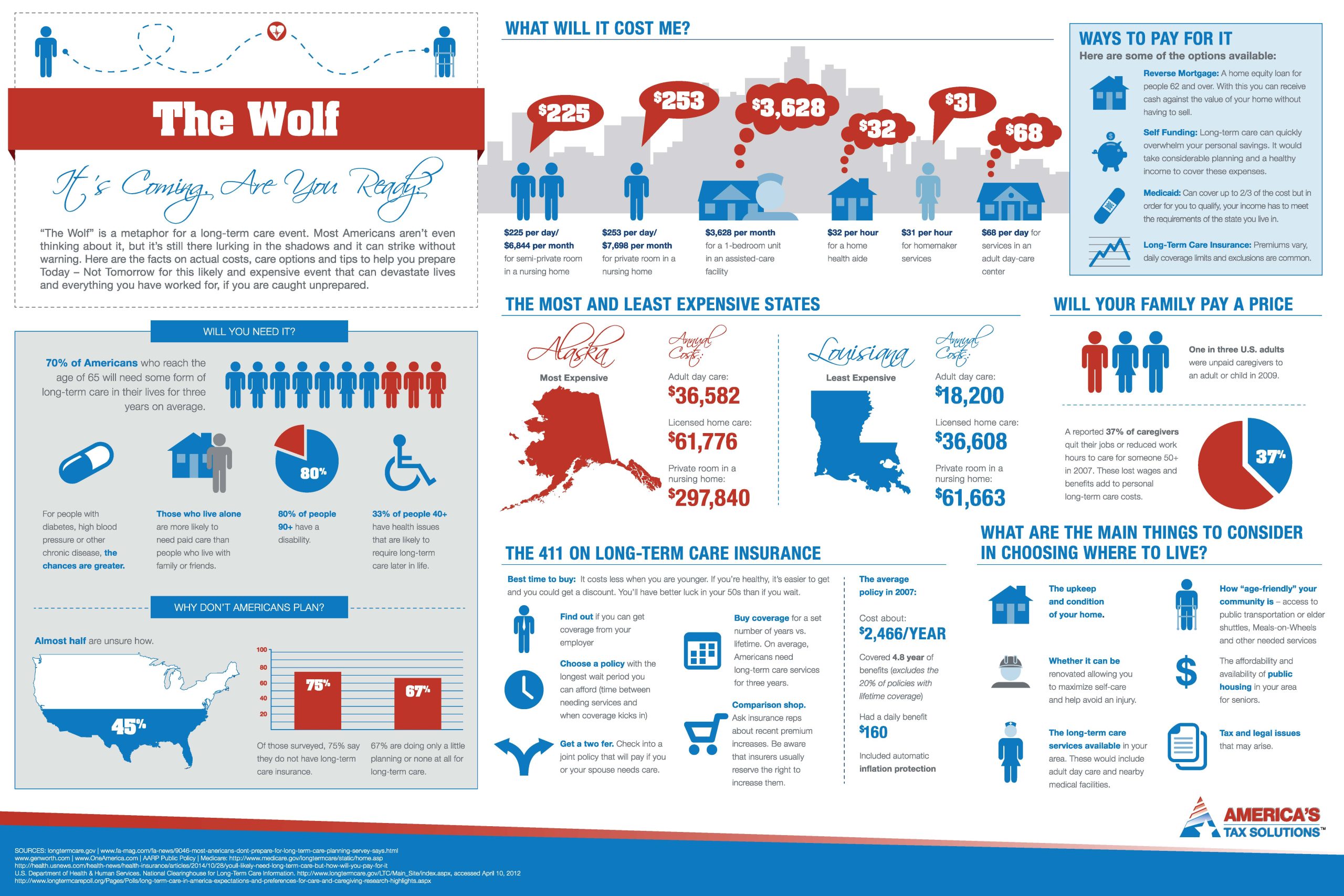

Long-Term Care will affect at least 70% of the population prior to death:

We have the solution:

The biggest risks individuals have with retirement are as follows:

Longevity – Market Risk – Interest Risk – Tax Risk

But there is one risk larger than all of these four risks — Catastrophe of a Long Term Care Event- that can last from as little as four months to ten or more years. It affects us financially, at $100,000 per year minimum, emotionally, psychologically and physically . One Long Term Care event can destroy a lifetime of savings.

The good news: We have a solution that most of the time doesn’t cost you anything!

We can’t prevent a Long Term Care event from happening but we can help you plan, maintain and avoid disasters while we help you protect your retirement.

Single Pay – 20-Pay – Age 65 Paid Up – Annual Pay

Guaranteed premiums for life – No premium increases ever!

50 Months – Lifetime Option Rider – Inflation Option Rider – Single Life

Patent-Two Lives: Any beneficial interested party, i.e., Husband/Wife, Brothers/Sisters, Business Partners. Age difference up to 25 years with Age 80 max.

Always greater than the premiums paid.

Always a Return of Premium if the client wants to cancel prior to receiving benefits.

All Rights Reserved by Financial Independence Co. Insurance Services (FICIS)

We do not offer every plan available in your area. Currently, we represent 8 organizations which offer 75 products in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Assistance Program (SHIP) to get information on all of your options. This is a proprietary website and is not associated, endorsed or authorized by the Social Security Administration, the Department of Health and Human Services or the Center for Medicare and Medicaid Services. This site contains decision-support content and information about Medicare, services related to Medicare and services for people with Medicare. If you would like to find more information about the Medicare program please visit the Official U.S. Government Site for People with Medicare located at http://www.medicare.gov